By Kathryn Hardison – Staff Writer, Austin Business Journal

Tesla Inc. CEO Elon Musk’s confirmation of plans to manufacture cars in Austin was a game changer.

With it came the promise of thousands of jobs, a major infrastructure project and a monumental boost to the local economy amid a global pandemic. It also underscored a growing trend of major companies flocking to Central Texas from the coasts.

As the first major car plant in the Austin area, the Tesla gigafactory will have a massive economic impact. But it also comes with unanswered questions. Can Austin produce enough workers for Tesla? How will Tesla impact housing, which is notoriously low on supply? What about affordability concerns? Will small, local businesses be able to compete for young talent?

Those who have seen the multibillion-dollar company’s impact firsthand admit there are positives and negatives. Tesla (Nasdaq: TSLA) broke ground on its gigafactory in Sparks, Nevada, about 20 miles east of Reno, in 2014 — and since it opened in 2016, it has raised concerns about worsening affordability.

“We weren’t prepared for the huge, positive impact Tesla had, as well as the many challenges … and we’re still grappling with those,” said Ann Silver, CEO of the Reno-Sparks Chamber of Commerce. “From a housing and transportation perspective, I don’t think we were entirely, at the time, on top of what that impact would be.”

Even before Tesla picked Austin, affordability issues have mounted from a culmination of company relocations, higher wages, continued development and a population boom. Now that Tesla — the world’s most valuable carmaker — is throwing its money and resources into the city, it begs the question: Can Austin handle Tesla’s impact?

Preparing a workforce

Musk has long boasted that you don’t need a college degree to work at Tesla, which sources said could push other employers to adopt similar standards.

Tesla plans to create at least 5,000 jobs, which will likely lead to thousands of relocations to Central Texas as the facility reaches full capacity over the next few years — from both Tesla employees and those working for companies in the manufacturer’s supply chain.

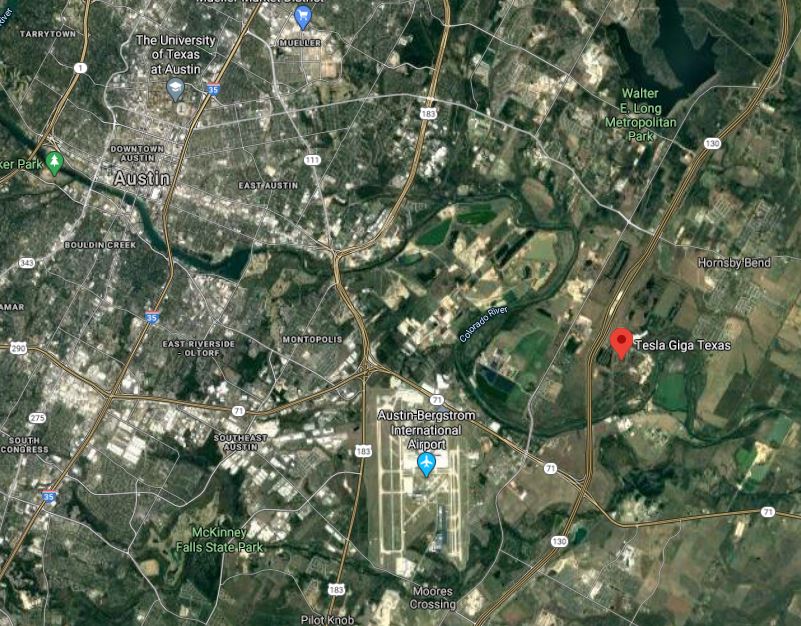

By press time, almost 100 job openings were posted on Tesla’s website, about one-third of which were related to the construction of the gigafactory — a 4 million- to 5-million square-foot facility underway on about 2,100 acres in East Austin. Musk has confirmed the facility will be up and running by next year and even producing its Model Y cars. The company may also be manufacturing the battery cells for its cars at the facility, according to filings with Texas Commission on Environmental Quality.

In Reno, Tesla started conversations about opening a gigafactory at the tail end of the Great Recession and pledged to create 6,500 jobs — and it did, Silver said.

People flocked to the Western Nevada city from California and the surrounding areas to fill the thousands of jobs, alongside those who already lived in the area. It jumpstarted the economy, Silver said, and other big employers such as Amazon and Switch followed. But the companies drained the workforce pipeline for the area’s small businesses.

“It’s sort of a Bermuda Triangle effect. It’s great to have the economic development, in terms of Tesla being in our community … but we didn’t have enough workforce to begin with,” Silver said. “When you bring (Tesla) in, and they have a certain magnetism for 18- to 35-year-olds … you’ll have small businesses saying, ‘I can’t find people because they’re going to Tesla.’

“It depleted our small businesses pretty rapidly, and we weren’t prepared for that.”

There’s concern that this same outcome could be in the cards for Austin, which already has an established high-tech manufacturing sector. Ed Latson, executive director of Austin Regional Manufacturers Association, said he expects area manufacturers may see employees jump ship for Tesla, which will be offering an average salary of over $47,000, health insurance, paid leave and equity in the company.

“The skills needed within those companies are similar that Tesla will need to build electric vehicles,” Latson said. “They’re going to be attracting people away from these companies, and other manufacturers need to be working on developing the talent pipeline to ensure that when new companies move to a region and add 5,000-plus workers that we have ways to backfill that.

“That’s going to be the role of the community. We’re going to have to all pull together to make this thing a success.”

Because of the scope of the carmaker’s planned operations, Latson said at Austin Business Journal’s East Austin Growth Summit on Oct. 29 that Tesla could create closer to 15,000 jobs. He also anticipates around 50 companies will move to Austin to support Tesla’s supply chain, and he said he hopes another 50 local companies will be able to work with the carmaker.

Manufacturing employment in the Austin area grew 27% from 2009 to 2019, and there were nearly 450 high-tech manufacturing firms in the region last year, according to Texas Workforce Commission data. And high-tech manufacturing represented 63% of the region’s manufacturing employment last year, according to the data, with large companies such as Samsung and Applied Materials employing thousands.

Tesla, which has seen its share price increase by more than 4,000% since its 2010 IPO, was approved for $60 million in tax breaks and rebates from Travis County and Del Valle Independent School District this summer. Tesla is required to recruit workers from Del Valle schools, Workforce Solutions Capital Area, the county’s workforce program for those leaving the criminal justice system, historically Black colleges and local training and apprenticeship programs, according to the performance deal with the county.

“They hire everyone from a high school student all the way up to Ph.D.s,” said Charisse Bodisch, senior vice president of economic development for the Greater Austin Chamber of Commerce. “That was one of the big reasons why Austin was on their short list is because we have that type of employment base.”

Jobs listed on Tesla’s career page included software engineer, commercial field service technician and global supply manager. And they all came with different job requirements.

Laura Marmolejo, manufacturing department chairwoman at Austin Community College, said the college is trying to strengthen the area’s manufacturing talent pipeline, which she admits hasn’t met job demand.

“We’re trying to eliminate that,” she said, adding that keeping the workforce pipeline strong will keep attracting outside companies. “We’re doing better at reducing that need but we’re not there yet.”

Marmolejo said the college offers an eight-week crash course in manufacturing production and is prepping a manufacturing incubator to fuel job growth. She declined to comment on whether ACC was working directly with Tesla. The car manufacturer worked closely with Truckee Meadows Community College in Reno to create an apprenticeship program.

There’s also overflowing optimism locally that Tesla will play a part in aiding the city’s unemployment rate, which recently ticked up after months of decline. The jobless rate jumped to 6.4% in September with 80,800 unemployed, up from an unadjusted rate of 5.5% in August, according to data from the TWC and the U.S. Bureau of Labor Statistics.

Bodisch said there’s already an eager crowd of unemployed people in Austin who could switch career paths with Tesla.

“The hard, cold fact is that some of that retail and some of those positions may not come back for a long time, and some of them may not come back at all. … This may be a new career path for them,” Bodisch said. “I don’t think they’d come here if they didn’t think they were going to get the employees.”

The impact on housing

Affordability, which wasn’t an issue in Reno prior to Tesla’s arrival, quickly became a concern and still remains a problem today.

Tesla, and the other big companies that followed, began offering wages higher than what small businesses were already offering, and with that, housing prices have steadily risen over the past six years — an “unintended consequences of something so positive,” Silver said.

At the beginning of 2014, homes in the Reno area were valued, on average, at $234,000. As of last month, that’s increased by almost 77% to $414,000, according to data from Zillow. By next year, that’s expected to rise to $469,000, despite the Covid-19 pandemic.

Of course, affordability is not a new challenge in Austin. With tech companies flocking from the coasts and wages following, the cost of housing has become unattainable for many in Austin, pushing more people farther out from the urban core. According to the Zillow data, Austin’s average home value has spiked 56% since 2014 to about $431,000 last month.

A housing shortage is evident, too, which developers are attempting to fix as thousands of rooftops are underway in the suburbs. In September, the housing inventory in Travis County fell to 1.3 months of inventory and Williamson County dropped to 0.8 months, according to data from Austin Board of Realtors. Six months of inventory is considered a healthy market.

According to Bodisch, it’s hard to say whether Tesla’s employees will be able to afford an apartment in Austin or a house in the suburbs because each employee’s overall household income will be different. Though it’s unknown exactly how Tesla will affect the area’s existing affordability challenges, Bodisch said the company’s jobs are “extremely positive” for the local economy and that she’s heard of housing developments “appropriate for the employees” that will follow Tesla to the State Highway 130 corridor.